Doctors work most of our lives to build capital (assets) so that we may one day ‘retire’ or slowly phase into the twilight years. Perhaps you become financially uninhibited at a much earlier age. Time to unwind and enjoy more of the fruits of life. When do you actually stop investing as a medical professional? Perhaps never. Even in retirement a person may have another 10 to 50 years of life ahead. More and more thought is provided towards longevity risk – that is the risk of living beyond life expectancy and the funding of it for lifestyle purposes and at a basic level, for survival.

There are varied ways, types and styles of investing. Some people build assets via direct property, businesses/practices, working in corporate life and gaining equity stakes, some people inherit and some invest in portfolios that seek to balance the investments according to their investment risk appetite and tolerances via superannuation and/or investment portfolios. Then again some trade shares, options, warrants, futures, currencies and commodities as a living. A Mathematics professor in the US once told us that Financial Traders are literally gamblers. Maybe Goldman Sachs or JP Morgan can shed light on this as they have very profitable financial trading arms of their businesses?

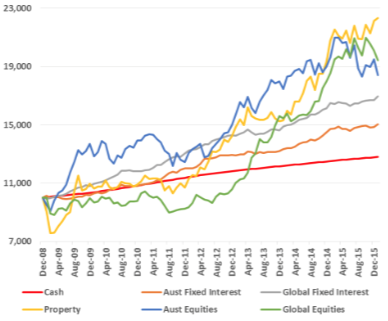

Cumulative Asset Class Returns 2008 – 2015

The above chart shows the cumulative returns of Cash, Property, Australian Fixed Interest (Term Deposits, Bonds, Treasury Notes, Government & Corporate Debt), Australian Shares, International Fixed Interest and International Shares from December 2008 to December 2015.

Property and shares values (see above chart) have basically doubled in value since December 2008, however, and in our opinion, the composition of investment portfolios in a wealth advisory capacity should consider the fact that more than 97% of active fund managers cannot outperform the market on an after tax basis over a 10 year period of time. This is evident via numerous research conducted over the past 20 plus years. When you consider that active fund managers typically charge investment management fees (ICR/MER) typically between 1% – 3% pa for their service, some thought should be directed towards the logic behind building investment portfolios based on active funds management.

The portfolios that Elixir Wealth Advisory compose for clients have a passive stance via a core/satellite approach towards investing. The investment management fees of the portfolio ranges from 0.20% pa to 0.32% pa — lower than nearly all Australian Industry Superannuation fund investments and most definitely all active fund managers.

To also be considered is the Asset Allocation of the portfolio as it alone can contribute up to 75% of the return of the portfolio. Much attention is placed towards obtaining the right balance for each client’s portfolio. Asset Allocation is dynamic and may be tactical (short to medium term focus) as well as strategic (medium to long term focus) depending on the economic and market conditions.

To invest is to plant a seed for tomorrow. We rely to a large degree on our ability to earn income so that we may invest for ourselves, our children and their children’s futures. Once we’ve made a decision to retire and can afford not to work, we draw upon our lifetime of accumulated investments (superannuation/other investments) to carry us forward to the next phase of life. The value of professional wealth advice during your time on earth, we must say, is absolutely priceless.