Is it something you should consider?

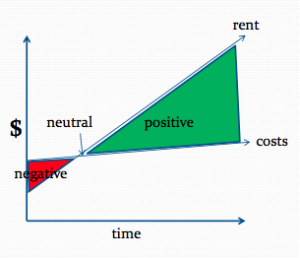

Negative gearing (Gearing) is when your investment expenses exceed the income generated off those investments; this includes property, shares, managed funds or other types of investments. It allows you to increase the amount you have invested and offers a range of potential tax benefits; remember the amount invested/borrowed is directly correlated to risk (Gains and Losses). As Gearing is inherently risky it’s best to seek professional advice before making any long term commitments. The following is general advice only.

Typical Tax Treatment of an Investment Property

A typical example of a Geared Investment below might result in $39k in expenses and only $18k of rental income (see table below). This would result in a tax deduction of $21k [= ($39k) + 18k]. Instinctively you think this is a great result as you’ll pay less tax; but is it?

What you would have noticed in the table above is Interest and Depreciation make up the majority of the tax deductions. You could also add in Insurance, Travel to Body Corporate Meetings and Repairs and Maintenance for a more comprehensive cash flow analysis. For later, remember depreciation is a non cash expense, but it also reduces the cost base of your investment which in-turn increases the capital gain.

Based on the table below you could quickly draw the conclusion if you’re in the highest marginal tax rate, a $10K tax saving is a pretty decent result, and I should contact a real estate agent to buy a property today. When you look a little closer, you’ll realise all marginal rates are cash flow negative, meaning you need to fund the shortfall out of your spare personal cash flow until the property is either neutrally or positively geared. At this point if you don’t know what your spare personal cash flow is, stop and prepare a personal budget listing all of your income and expenses per year to determine an accurate saving capacity. We never recommend undertaking a Gearing strategy until this is known; “investors don’t plan to fail, they fail to plan”.

Where there’s capital appreciation and spare personal cash flow, funding the difference may be the right thing to do. Especially with some of the returns we’ve recently experienced. If you’re marginal tax rate is 49% the shortfall after tax is approximately $2K per annum, this is based on an interest only loan of $500,000 @ 5%. Assuming nothing else changes except interest rates increase to 7%, the shortfall would increases to $7K per annum.

Applying the same change to a marginal tax rate of 34.5% the shortfall increases from $5k to $11k per annum.

Assuming an investment period of 10 years and a conservative average capital growth rate of 5% pa (CoreLogic RP Data Home Value Index showed 9.8% growth for the 2014/2015FY). The investment would return a gross gain of $402k, resulting in a tax liability of $98k [402,000 x 50% x 49%]. This tax result assumes top marginal tax rates are applicable on the entire gain but can be reduced through effective tax planning; contact us if you’d like to know more.

The aim of investing is to make a profit, and Gearing aims to do this by providing immediate tax deductions to reduce current year taxes; while hoping the asset appreciates in value over time. This strategy ultimately assumes assets always appreciate and the Government does not change legislation to limit the amount of tax losses an investor can claim on a Geared investment.

Assuming assets appreciate and the government sticks with existing policy, Gearing provides you with two tangible benefits;

- Time value of money (a dollar today has more buying power than the same $1 in 10 years) and

- It converts revenue into capital so you can apply the general capital gain discount of 50%.

This would produce a hypothetical return of $318k on a $500,000 interest only property investment after 10 years (excluding time value of money).

These Gearing strategies can be applied to Shares, Managed funds and other types of investments to gain tax benefits. Each class of investment has its own risks and reward, and they should be discussed with your financial planner to ensure you’re not just chasing a tax benefits.

Gearing should be considered as part of a comprehensive investment strategy but it will not suit everyone needs. Note as Gearing is complicated it’s best to seek professional advice before making any long term commitment; by talking to us you’ll gain a comprehensive understanding of how Gearing works, and we’ll help you to evaluate and unlock any potential opportunities.

Gearing can be used to reduce PAYGW obligations

If you’re already negatively gearing investments you may want to consider the benefits of reducing your withholding rate to better match your year-end tax liability.

If you’re an employee and you believe your circumstances warrant a reduction in your PAYGW rate, you can apply to for a variation using the ATO’s PAYG income tax withholding variation (ITWV) application (NAT 2036). This will effectively reduce your tax return refund to neutral as you gain the benefit during the year through lower PAYGW.

Subdivision of Land is typically not classified as Negative Gearing

Don’t get negative gearing confused with property development. The Income Tax Assessment Act and the ATO view these as two different areas of tax, and they both have their own advantages and disadvantages.

If your intention when you purchase a property is to develop, the ATO will view this as a business and you’ll be assessed accordingly. In addition to income tax you’ll also be liable for Goods and Services tax on the sale. This means you can’t access the Capital Gain tax exemption provisions such as Principal Place of Residence and 50% general discount. Before proceeding with any type of property development or subdivision contact us to reduce your tax risk exposure.