A brief analysis

Recent release of study and research completed by the Reserve Bank of Australia may indicate that negative gearing is mostly for the rich.

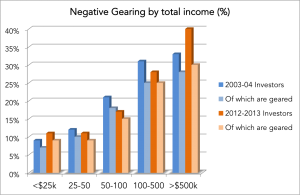

Why is RBA interested in this information? There is a tax mix of generous tax deductions for interest payments and capital gains which creates essentially the “property market speculation”. The boom-and-bust cycles in the housing market make RBA’s job difficult in setting the interest and cash rates. RBA’s commentators believe the tax statistics are skewed. They only cover taxable income and leave out a huge non-taxable income from superannuation.

Many older income earners would have low taxable income from wages but significant tax-free income from super.

| Taxable income | Individuals | Net Tax | |

| (%) | $m | (%) | |

| <$18,200 | 19.8 | 79 | 0.1 |

| $18.201-$37,000 | 24.3 | 4,178 | 2.7 |

| $37,001-$80,000 | 37.4 | 46,905 | 30.3 |

| $80,001-$180,000 | 15.9 | 60,380 | 39.0 |

| >$180,001 | 2.7 | 43,341 | 28.0 |

| 100 | 154,880 | 100 |

Net tax by tax bracket, 2012-2013, only 18.3% of those who negative gear have taxable income over $80k

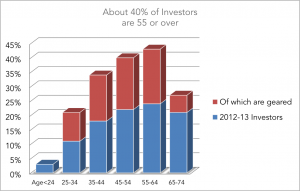

The research shows that in 2012-13 about 18 per cent of taxpayers who are over 65 use negative gearing. In loans made in that period a typical older taxpayer was about 10-times more likely to negatively gear than a low-income one. For people declaring taxable income over $100,000, around one in every three has a negatively geared property and for people with less $100,000 it is about one in every six.

Property Investor by age (%)

Surgeons and anaesthetists have the highest propensity among the professions for investing in rental properties, and the highest average tax benefits. Twenty-eight per cent of surgeons claim deductions for losses on rental income, and earn an average tax benefit of $4,161.

Anaesthetists are even more likely to take a plunge on a loss-making rental property, with 29 percent claiming rental losses and earning average tax benefit of $3,352. (wrong investment strategy)

In sharp contrast government speculations and policies mis-classifies “the biggest users of negative gearing” to be teachers or police who are less likely to own a negatively geared property.

These estimates are the figures obtained from Australia Tax Office data for the 2012-13 tax year.

The total rental losses claimed in 2012-13 were $12 billion.

If you are a specialist consultant, ANZCA or a Physician in general and your tax minimisation approach and policy has been investment property and negative gearing we encourage you to contact this practice. Our specific Tax Planning Programme has allowed our medical practitioners to “balance out” their exposure to real estate for benefit of tax savings only, whilst they take significant advantage in tax savings via our blue print Tax Advisory and Planning. [contact us]

Elixir Wealth Advisory © Negative Gearing & Income | 2012-13 FY Data