Financial Specialist for Medical Professionals

The situation may not be quite as bad in the other capital cities – but it is still very difficult for younger people to buy...

A discretionary trust addresses the relationship in which one person legally owns an asset for the benefit of another person...

The problem is, compared to previous years, the 2017 Budget was a bit of an anti-climax. In previous years, there have been a number of...

We work most of our lives to build capital (assets) so that we may one day ‘retire’ or slowly phase into the twilight years. Perhaps...

Given the volatility of investment markets all around the world since the beginning of 2016, a larger weighting towards defensive assets is a good thing...

A brief analysis Recent release of study and research completed by the Reserve Bank of Australia may indicate that negative gearing is mostly for the ...

In the 2013 financial year the government introduced Division 293; it’s effectively a tax on high income earners as it requires you to pay an...

The cases below highlight cases with Medical Doctors who had suffered from poor advice. It is rather dis-heartening and unfortunate to encounter the extent...

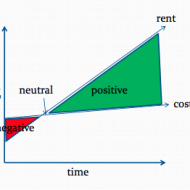

This discussion aims to illuminate portfolio composition costs, the transparency of investment portfolios and how it can affect the performance of investments. The chart below illustrates...

Is it something you should consider? Negative gearing (Gearing) is when your investment expenses exceed the income generated off those investments; this includes property, shares...

The predominant difference between a contractor and employee is the eligibility for tax deductibility. As an employee, you will only be able to deduct expenditure(s)...

One of the basics of taxation involves whether you are a resident or non-resident of Australia for tax purposes. Different rules and taxation rates apply...

In Australia, income is typically classified as either ordinary or capital income. There are considered to be three components of Ordinary income: Income from personal...

Advanced Debt Management© – A Perpetual Borrowing Model© What is so unique about our advice method is that, we place the ‘tax’ in the centre of...

Agility and Harmony The ability to adapt, be flexible and integrated is key. Investment recommendations are backed up via thoughtful research, strategy and analysis of all...

The following financial modelling charts illustrate examples of actual results obtained [in the first year] from the provision of our advice for a Doctor aged...