It is not always about the interest rate

Seldom, happens the opportunity to envisage and examine your finances from every outlook. Consulting with us begins with meeting a team of experts. There is no oversight, there is no comprise. There is synchronicity, clarity and completeness – because we believe only everyone knows everything.

All along the consultation with us, an adviser from a specialist discipline searches into every objective that you consider. When we arrange for your debt and review your provision to use borrowing, our investment committee assesses the cost outlay and capital requirements, the Tax Planning division looks at the tax effectiveness and the best method to account for it. Our Research & Analytics determines the feasibility and then; a comprehensible credit recommendation is compiled.

Read the case study on debt management for 41 year-old obstetrician. [Click here]

Consult with us on:

|

|

|

|

|

|

|

|

|

Portfolio debt

|

Meticulous Judgement

The use of borrowing as a powerful tool has been centric to investing and wealth. Essentially the use of borrowed funds to invest, acquire an asset or to finance or fund a trade, allows for exertion of leverage – or so to speak Gearing.

Gearing in simple term is the utilisation of loaned capital for an investment, expecting the profits made to be greater than interest payable. Micro-enterprise and consumer borrowing like resembles several key principles of management and weight of debt; the cost of borrowing, net liability position, credit worthiness and budget deficit/surplus.

However the intrinsic disparity between consumer debt and use of borrowing in a commercial context is the cost of borrowed money and managing Tax. [more…]

Hand-Picked

At Elixir Wealth Advisory it is our strong belief that the need and complexity of high net-worth individuals is at a far greater level than “just a home loan and an offset account”. Detailed intelligence of the entire spectrum of lending products Australia wide is an absolute in our practice.

Systematic expertise and broad knowledge of all lending institutions credit policy and appetite gives us the unprecedented agility to achieve the most tailored borrowing arrangements for you.

Because of the nature of our relationships with most and major lending and banking institutions, Elixir Wealth Advisory’s clients have select access to the most competitive interest rates and borrowing facilities. Our exclusive clients are entirely private banked with red carpet service standards.

Insight & more

Borrowing is ability to obtain good and services before payment, based on the trust that payment will be made in future. This concept of financial standing and solvency gave birth to one of the founding causes of modern capitalism and economic growth, the Capital Markets.

A market place that traditionally channeled the wealth of savers to those who could put into long term use such as investors, debtors or businesses. Capital Markets are key components of a functioning economy and capital is vital to economic output. The size of a nation’s capital market is directly proportionate to the size of its economy. In today’s modern economy, capital markets are globally interconnected. In 2007-09 we experienced the drawback of this interconnection illustrated by global credit crisis where trillions of dollars of mortgage-back securitisation collapsed and as a world economy we experienced recession. Key economic measures, complex monetary equations, reserve banks and econometric are intertwined with Credit Markets and Lending environment. Australia as an economy, inherited, adopted and practiced a regulated debt landscape.

Traditionally, at any given time debt is computed and classified as government debt and private debt within banking sector – private borrowing is primarily held in business debt, household debt, owner-occupied and investor housing debt. From macro strategic perspective at any period the Reserve Bank of Australia would look at the target cash rate, interest rate on government debt (foreign borrowing) and CPI. Then the money supply is measured and economic growth or shrinkage is forecast-ed. The regulatory bodies are able to govern and intervene policies around different lending sectors to impact the economy and fiscal management. Above coupled with exceptional progression in credit record, scoring and management over the years and recourse mortgages has shaped a near perfect lending model for Australia and credit confidence.

Bank's Business

Regular bank lending is not usually classed as capital market transaction. A key difference is that with a regular bank loan is not securitised. Even though the term ‘security’ or secured lending is most frequently linked with real property collateral in mortgage lending, the bank lending does not constitute the form of resalable security like bonds traded on the market. Bank depositors and shareholders tend to be more risk averse than capital market investors and that inherently limits institutional lending as a source of finance.

However banks are accessible and more importantly they have the unique ability to create money as they lend. Lending institutions usually obtain cheaper or technically called ‘wholesale’ funds. This is typically sourced through domestic deposit markets. From the distribution point of view they will then develop products, loan and forms of personal lending or credit lines. Fundamentally banks employ a ‘risk-based’ pricing model, lending or credit criteria for their products and their borrowers.

At consumer and retail investor height in Australia, banks by majority are suppliers of debt merchandise.

Exposure

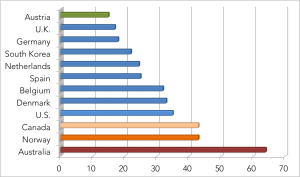

In 2013, a detailed and highly comprehensive research conducted by Moody’s analytics of International Monetary Fund concluded that Australian Banking Sector has the highest exposure to Residential Mortgages in the world.

With the absence of any publicly supported securitisation market — such as that provided by Fannie Mae and Freddie Mac in the U.S. — and a currently weak private securitisation market, any new mortgage origination stay on banks’ books. Major and non-major Australian banks have been comfortable with residential real property as collateral for their lending appetite and managing and absorbing the risk on their books (internal securitisation) – in our opinion this has been to a degree to do with a mature banking system, a stabilised credit growth, exceptional consumer credit behaviour and the Australian best-hedged economy.

The high degree of exposure to the domestic mortgage can raise concerns – such as surge in housing prices and constant regulatory warnings by APRA around dictating minimum liquidity adequacy.

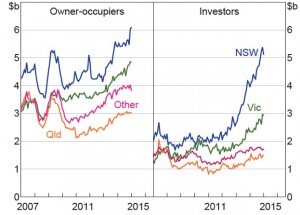

The data charted to the right, suggest the strong and exponential growth in housing loan origination and approvals.

The current credit market, a steady growth in housing sector mainly driven by supply, demand and market sentiment and profitability in lending have been significant factor in propelling mortgage origination and lending appetite for major banks and non-major lending institutions.

Australia’s ‘big four’ are among the world’s 50 safest bank according to a study carried by Global Finance magazine.

Elixir Wealth Advisory Key Features Brochure

Elixir Wealth Advisory Full Brochure 2016

Medical & Dental Financial Services | ABN 27622366643 is an Authorised Corporate Credit Representative (ACR 504468) of Outsource Financial Pty Ltd | Australian Credit License 384324