8 minutes

A Real Return with High Conviction

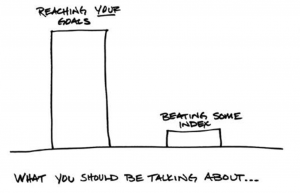

“The best way to measure your investing success is not by whether you’re beating the market but whether you’ve put in place a financial plan and a behavioural discipline that is like to get you where you want to go.” ~ Benjamin Graham

Our investment recommendation, belief and philosophy at Elixir Wealth Advisory evolves with expert opinions in the market; not merely by market conditions.

Our investment recommendation, belief and philosophy at Elixir Wealth Advisory evolves with expert opinions in the market; not merely by market conditions.

We put our investors first. We are independent-minded. We strive to minimise costs and invest for long term.

These fundamentals have been centric to how we have built our clients portfolios and have managed their money – concentrated diversification and buying with the margin of safety. We have began to realise being “independent-minded” in the current globally interconnected and vast financial markets is looking for Absolute Value; and not just Relative Value.

What is Outcome-Based Investing?

When we specify return or even risk goals, we model and build portfolios (basket of assets) that are strong contenders for financial plannings – this is achieved via Outcome-Based Asset Allocation.

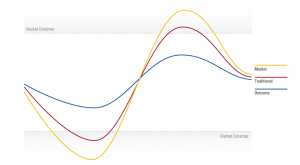

Traditionally, fund managers due to regulatory, technical and technology restrictions choose Static Asset Allocation approach. In other words, your financial planner puts together a portfolio for you and perhaps every year (at best) reviews and make some tweaks or changes based on the performance or market conditions.

At Elixir Wealth Advisory, we have been able to overcome this barrier by partnering with the most advanced and one of the largest investment research house globally to achieve a new portfolio modelling approach for our clients; which allows dynamic allocations with a set of outcomes/objectives.

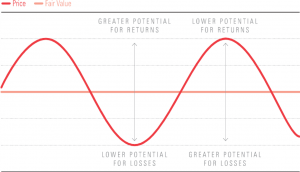

If we group asset allocation or investment approach, or general market conditions into Low Risk and High Risk Market Environment, the gap of missing opportunities through value-driven investment will present itself more clearly.

Equity markets have disappointed, valuations look reasonable, Bond markets offer higher than historical yields. (Low-Risk Approach)

Equity markets have generated multi-year gains, valuations look stretched, Bond yields are low, defaults are picking up. (High-Risk Approach)

You are either running low cash levels or high cash levels models in static asset allocation approach; which inherently restricts the ability to shift, find value in the both spectrum ends of the market and invest dynamically.

The implication of outcome-based investing or Value-Driven Asset Allocation will only mean, less turbulence and volatility in the life of your investments – this will enable investors to have high levels of transparency and advisor to steer away from overreacting to market conditions.

“In The Theory of Investment Value, written over 50 years ago, John Burr Williams set forth the equation for value, which we condense here: The value of any stock, bond, or business today is determined by the cash inflows and outflows — discounted at an appropriate interest rate—that can be expected to occur during the remaining life of the asset.” ~ Warren Buffett, Berkshire Hathaway’s 1992 AnnualReport

In the broad investment universe, the advanced and dynamic model of Value-Driven Asset Allocation, in simplicity is about identifying investment ideas by grouping Securities based on Country, Quality, Sector and Region and Bonds based on Country, Credit, Rate and Region.

The extra, but very clever level of consideration given to these selections, are metrics that allows evaluating according to conviction. These metrics are Absolute Valuation, Relative Valuation, Contrarian Indicators and Fundamental Risk.

It is Price Vs. Fair Value.